The Case for Alternative Investment Funds

Traditional investment vehicles are limited. Retirement accounts tie up money for decades. Real estate is illiquid and overpriced. Index funds rise and fall with the market, offering little control.

An alternative investment fund like RENTDUE Capital provides a different path:

- Liquidity – Investors aren’t locked up for years.

- Diversification – Returns don’t depend on one asset class.

- Cash Flow – Investors can choose to withdraw profits or reinvest.

In short, it’s a fund designed for today’s challenges, not yesterday’s strategies.

How RENTDUE Capital Trades Options

At its core, RENTDUE Capital is an options trading fund. But unlike speculative traders who gamble on risky moves, RENTDUE uses options conservatively.

- Call options capture upward momentum.

- Put options protect against downward swings.

- Strict risk rules ensure no more than 1% of capital is exposed per trade.

- Daily controls stop trading after small losses to prevent emotional decisions.

The fund typically averages two trades per day, focusing on liquid assets like SPY and QQQ, with occasional exposure to big-name tech leaders. The priority is always consistency, not betting big.

Why RENTDUE Capital Works

Most funds focus on quarterly or annual returns. RENTDUE Capital takes a different approach: the goal is 1% per week. That target is ambitious, but realistic given the risk controls in place.

- Track Record: Dozens of winning days for every losing one.

- Small Drawdowns: The largest losing day has been less than –0.20%.

- Transparency: Investors receive regular updates and verified results.

This structure makes RENTDUE Capital unique in the alternative investment space: growth that compounds weekly, with rules that protect capital.

Jace Vernon: The Mind Behind the Fund

Jace Vernon is no stranger to entrepreneurship. After years of building and scaling companies in real estate, marketing, and wellness, he shifted focus to capital markets.

He discovered that real estate—once his primary wealth vehicle—had become saturated and overpriced. Options trading, on the other hand, offered flexibility, lower capital requirements, and high potential when managed with discipline.

From that insight, RENTDUE Capital was born. His mission is simple: build a fund where accredited investors can experience strong growth without sacrificing liquidity or control.

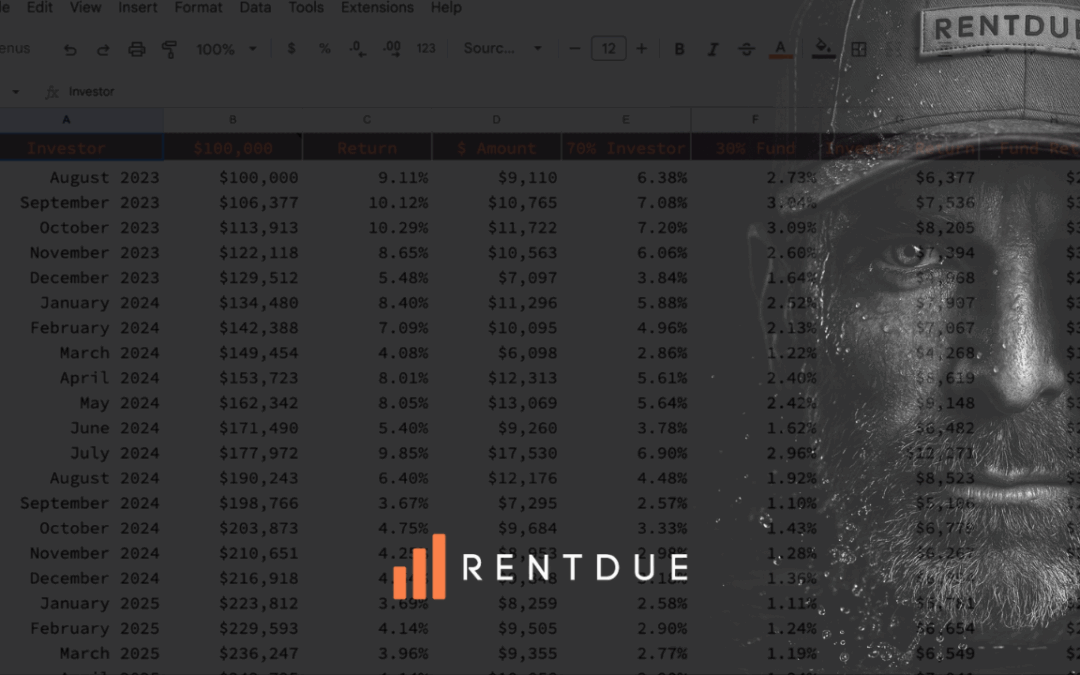

The Power of Consistency and Compounding

What makes RENTDUE Capital stand out isn’t just weekly returns—it’s the philosophy behind them.

Compounding works like a snowball. Gains stack on top of gains, and over time, the curve bends upward in exponential ways. With steady weekly returns, RENTDUE Capital gives investors the ability to accelerate wealth creation faster than traditional strategies.

To put it in perspective:

- $100,000 compounding at 30% annually grows to $1.3M in 10 years.

- At 40%, the same money grows to $2.8M.

The lesson is clear: when returns are consistent and time is on your side, wealth grows in ways most people underestimate.

Why Investors Are Choosing RENTDUE Capital

For accredited investors, RENTDUE Capital provides a unique balance:

- Minimum Investment: $100K.

- Withdrawal Flexibility: Capital can be withdrawn quarterly.

- Cash Flow or Growth: Investors choose to receive distributions or let profits compound.

- Transparency and Reporting: Regular updates build trust.

In a world where most funds restrict access or demand long lock-ups, RENTDUE Capital stands out by keeping money liquid and investors informed.

Getting Started

Investors who want to participate begin with a subscription agreement and wire transfer into RENTDUE Capital’s custodian account. From there, the fund starts trading immediately, and investors receive weekly and quarterly updates.

The fund is simple, transparent, and built around trust. No gimmicks. Just disciplined options trading designed to grow wealth steadily.

Conclusion

RENTDUE Capital is redefining what an alternative investment fund can be. With a focus on risk management, weekly consistency, and compounding growth, it offers accredited investors a smarter way to participate in the markets.

Led by Jace Vernon, this options trading fund blends transparency, liquidity, and discipline—qualities that are rare in the investment world today.

For those ready to explore a proven alternative, visit RENTDUECapital.com to learn how to put your money to work.